UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant |

| Filed by a party other than the Registrant |

Check the appropriate box:

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under Rule 14a-12 |

SELECT COMFORT CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

SLEEP NUMBER CORPORATION (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Dear Shareholders,

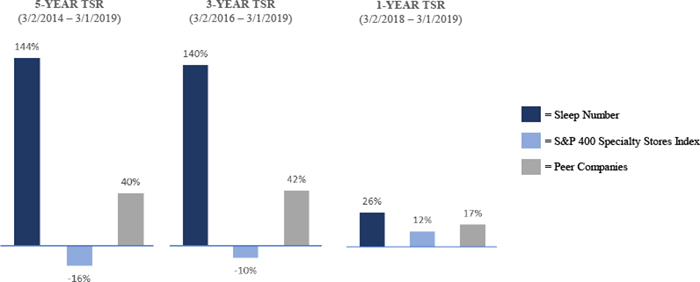

Sleep Number’s mission of improving lives by individualizing sleep experiences is at the core of our purpose-driven company. To date, we have improved the lives of more than eleven and a half million people. Our consumer innovation strategy translates directly to increased shareholder value. Over the past five years, our strategic consistency, profitable investments, and sleep innovations have generated total shareholder returns of 144% through March 1st, 2019.

We have prioritized approximately $500 million in investments since 2012 to strengthen our competitive advantages of proprietary sleep innovations, exclusive distribution, and lifelong customer relationships. These strategic choices contributed to a 16% return on invested capital for 2018, compared to our high single-digit weighted average cost of capital.

Our revolutionary Sleep Number 360® smart beds have disrupted the industry. With the only bed that delivers proven quality sleep, Sleep Number is at the intersection of sleep, technology and health trends. Consumer enthusiasm for our smart bed drove double-digit sales growth since we completed the transition of our product line in the back half of 2018. Record full-year results included:

| ● | Net sales increase of 6% to $1.53 billion, and |

| ● | Earnings per diluted share increase of 24% to $1.92. |

In 2019, we expect to generate earnings per diluted share of between $2.25 and $2.75, up 17% to 43% versus prior year.

9800 59th Avenue NorthSleep Number 360 smart bed

Plymouth, Minnesota 55442Five years ago, we saw the potential of connected technology and incorporated biometric tracking into our Sleep Number® beds with SleepIQ® technology. Today, more than half of consumer households are interested in purchasing sleep tracking technology. Our 360® smart beds detect movement, sleep disturbances, and biometric changes, and then use that information to automatically adjust the bed’s firmness for each individual sleeper.

We are communicating the vital role that this life-changing sleep plays in overall wellness through our integrated marketing campaigns, storytelling, and social media. We are amplifying our purpose-driven brand through groundbreaking partnerships with the NFL, the NFL Players Association, and the Professional Football Athletic Trainers Society. Now, over 1,800 NFL players are sleeping on our 360 smart beds and experiencing the powerful link between quality sleep and their performance.

Lifelong customer relationships with our brand are another key competitive advantage that drives sustainable, profitable growth. With digital at the core of our smart beds, customers now interact with our brand daily. They can use their SleepIQ® score to understand how quality sleep impacts their day. This deep engagement leads to increased customer loyalty, which drives higher referrals and repeat sales.

Our integrated online and retail strategy highlights the science and value of our smart beds. Our exclusive distribution is also an important competitive advantage. With award-winning store design and interactive technology, our 580 Sleep Number® stores deliver a unique sales experience across all 50 states.

The 360 smart bed is creating leverage across our business. With our full line of smart beds in place, we expect the absence of transition costs to benefit 2019. The simpler bed design and streamlined operational processes drive efficiencies in manufacturing, logistics, and supply chain. The multi-year network evolution is improving assembly flow, reliability, and scale.

Looking Ahead

In many ways, we are just getting started with our 360 smart beds, which have tremendous potential to add increasing value to consumers’ well-being. Today, our smart bed’s SleepIQ®platform captures over 8.5 billion biometric data points every night and uses that data to deliver proven quality sleep. In the future, SleepIQ technology will likely enable customers to use their smart bed to better manage their health and wellness.

We are excited to be in a position of broader relevance in a changing consumer and competitive landscape. We expect our purpose-driven company, which is delivering life-changing sleep, to continue to generate top-tier shareholder returns over the long term.

Sleep well, dream big,

Shelly Ibach

Sleep Number® setting 40, average SleepIQ®score of 82

President and Chief Executive Officer

1001 Third Avenue South

Minneapolis, Minnesota 55404

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 16, 201615, 2019

TO THE SHAREHOLDERS OF SELECT COMFORTSLEEP NUMBER CORPORATION:

Select ComfortSleep Number Corporation will hold its Annual Meeting of Shareholders at1:8:30 p.m.a.m. Central Time onMonday,Wednesday, May 16, 201615, 2019, at theMillennium Minneapolis Hotel located at 1313 Nicollet Mall, Minneapolis, Minnesota 55403 and. The meeting will be conducted completely as a virtual meeting via the Internet atwww.virtualshareholdermeeting.com/scss2016SNBR2019. The purposes of the meeting are to:

| 1. | Elect |

| 2. | Cast an advisory vote |

| 3. | Cast an advisory vote |

Shareholders of record at the close of business on March 21, 201620, 2019 will be entitled to vote at the meeting and any adjournments thereof.

Your vote is important. Please be sure to vote your shares in favor of the Board of Directors’ recommendations in time for our May 16, 201615, 2019 meeting date.

Your attention is directed to the Proxy Statement accompanying this Notice for a more complete statement of the matters to be considered at the meeting. A copy of the Annual Report for the year ended January 2, 2016 also accompanies this Notice.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDERS’ MEETING TO BE HELD ONMAY 16, 2016:15, 2019: The Proxy Statement and Annual Report for the year ended January 2, 2016December 29, 2018 and related materials are available atwww.sleepnumber.com/investor-relations.

These materials were first sent or made available to our shareholders on April 2, 2019.

| By Order of the Board of Directors, | ||

| ||

| ||

| Senior Vice President, | ||

| Chief Legal and Risk Officer and Secretary |

April 1, 2016

Plymouth,2,2019

Minneapolis, Minnesota

As used in this Proxy Statement, the terms “we,” “us,” “our,” the “company” and “Select Comfort”“Sleep Number” mean Select ComfortSleep Number Corporation and its subsidiaries and the term “common stock” means our common stock, par value $0.01 per share.

i

Minneapolis, Minnesota 55404

9800 59th Avenue North

Plymouth, Minnesota 55442

PROXY STATEMENT

FOR

FOR

ANNUAL MEETING OF SHAREHOLDERS

May 16, 201615, 2019

FREQUENTLY ASKED QUESTIONS ABOUT THE MEETING AND VOTING

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Select ComfortSleep Number Corporation for use at the 20162019 Annual Meeting of Shareholders.

When and where is the Annual Meeting and who mayhow can I attend?

The Annual Meeting will be held at 1:8:30 p.m.a.m. Central Time on Monday, May 16, 2016, at the Millennium Minneapolis Hotel located at 1313 Nicollet Mall, Minneapolis, Minnesota 55403 and15, 2019. The meeting will be conducted completely as a virtual meeting via the Internet at www.virtualshareholdermeeting.com/scss2016.Internet. Shareholders who are entitled to vote may attend the meeting and submit questions electronically during the meeting via live webcast by visiting the virtual meeting platform at www.virtualshareholdermeeting.com/SNBR2019. Shareholders will need the 16-digit control number included in personNotice of Internet Availability of Proxy Materials, on the proxy card, or viain the Internet.instructions that accompanied the proxy materials to enter the Annual Meeting. Shareholders may log into the virtual meeting platform beginning at 8:15 a.m. Central Time on May 15, 2019. The meeting will begin promptly at 8:30 a.m. Central Time on May 15, 2019.

Why is this Annual Meeting virtual?

We are utilizing technology to provide expanded access and participation, improved communication, and cost savings to benefit our shareholders and the company. Shareholders will be able to listen, vote, and submit questions from any remote location through the Internet. The virtual format for the Annual Meeting is also environmentally friendly and sustainable over the long-term.

What if I have technical difficulties during the meeting or trouble accessing the virtual Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or the meeting, please call the technical support number that will be posted on the virtual meeting platform log-in page.

Who is entitled to vote?

Shareholders of record at the close of business on March 21, 201620, 2019 (the “Record Date”) are entitled to vote at the meeting. As of the Record Date, there were 47,150,94930,127,273 shares of common stock outstanding. Each share is entitled to one vote on each matter to be voted on at the Annual Meeting. Shareholders are not entitled to cumulative voting rights.

If I am eligible to vote and want to attend the Annual Meeting, what do I need to bring?

Shareholders of Record. If you are a Shareholder of Record and plan to attend the meeting, please bring the notice of the meeting and photo identification. Shareholders of Record who do not present the notice of the meeting will be admitted only upon verification of ownership at the meeting.

Beneficial Owners. If you are a Beneficial Owner and plan to attend the meeting, you must present proof of ownership of the company’s common stock as of the Record Date, such as a brokerage account statement, and photo identification. If you are a Beneficial Owner and wish to vote at the meeting, you must also bring a legal proxy from your bank, broker or other holder of record.

What is the difference between “Shareholders of Record” and “Beneficial Owners”?

If your shares are registered in your name in the records maintained by our stock transfer agent, you are a “Shareholder of Record.” If you are a Shareholder of Record, notice of the meeting was sent directly to you.

If your shares are held in the name of your bank, broker, nominee or other holder of record, your shares are held in “street name” and you are considered the “Beneficial Owner.” Notice of the meeting has been forwarded to you by your bank, broker, nominee or other holder of record, who is considered, with respect to those shares, the Shareholder of Record. As the Beneficial Owner, you have the right to direct your bank, broker, nominee or other holder of record how to vote your shares by using the voting instructions you received.

If you are a Beneficial Owner and you do not give instructions to the organization holding your shares, then that organization cannot vote your shares and the shares held by that organization will not be considered as present and will not be entitled to vote on any matter to be considered at the Annual Meeting.

How can I receive proxy materials?

We are furnishing proxy materials to our shareholders primarily via the Internet, instead of mailing a full set of printed proxy materials to each shareholder.Internet. On or about April 6, 2016,2, 2019, we will begin mailing to certain of our shareholders a Notice of Internet Availability of Proxy Materials (the “Shareholder Notice”), which includes instructions on (i) how to access our Proxy Statement and Annual Report on the Internet, (ii) how to request that a printed copy of these proxy materials be forwarded to you, and (iii) how to vote your shares. If you receive the Shareholder Notice, you will not receive a printed copy of the proxy materials unless you request a printed copy by following the instructions in the Shareholder Notice. All other shareholders will be sent the proxy materials by mail beginning on or about April 6, 2016.2, 2019.

Requests for printed copies of the proxy materials can be made by Internet at http://www.proxyvote.com, by telephone at 1-800-579-1639 or by email at sendmaterial@proxyvote.com by sending a blank email with your control number in the subject line.

What does it mean if I receive more than one proxy card or Shareholder Notice?

ItIf you received more than one proxy card or Shareholder Notice, it generally means you hold shares registered in more than one account. If you received a paper copy of the proxy statementProxy Statement and you choose to vote by mail, sign and return each proxy card. If you choose to vote by Internet or telephone, vote once for each proxy card and/or Shareholder Notice you receive. If you have received more than one Shareholder Notice, vote once for each Shareholder Notice that you receive.

What are shareholders being asked to vote on?

There are three items to be voted on at the meeting:

| The election of |

| An advisory vote |

| An advisory vote |

What are my voting choices?

For proposal 1, the election of directors,Directors, you may:

| Vote in favor of all nominees; |

| Vote in favor of specific nominees and withhold a favorable vote for specific nominees; or |

| Withhold authority to vote for all nominees. |

For each of proposal 2 (the advisory vote onto approve executive compensation) and proposal 3 (the advisory vote on ratification ofto ratify the selection of independent auditors), you may:

| Vote in favor of the proposal; |

| Vote against the proposal; or |

| Abstain from voting on the proposal. |

How does the Board recommend that I vote?

Select Comfort’sSleep Number’s Board unanimously recommends that you vote your shares:

| “For” the election of each of the nominees for |

| “For” the advisory vote |

| “For” the advisory vote |

How are votes counted?

If you are a Shareholder of Record and grant a proxy by telephone or Internet without voting instructions, or sign and submit your proxy card without voting instructions, your shares will be voted “FOR”“For” each directorDirector nominee “FOR” proposal 2 (the advisory vote on executive compensation), and “FOR” proposal 3 (the advisory vote on ratification“For” each of the selectionother proposals outlined above in accordance with the recommendations of independent auditors).

Table of Contentsthe Board.

Proxies marked “Withhold” on proposal 1 (election of directors)Directors), or “Abstain” on proposal 2 (the advisory vote onto approve executive compensation) or proposal 3 (the advisory vote on ratification ofto ratify the selection of independent auditors), will be counted in determining the total number of shares entitled to vote on such proposals and will have the effect of a vote “Against” a directorDirector or a proposal.

If you are a Beneficial Owner and hold your shares in “street name,” such as through a bank, broker or other nominee, you generally cannot vote your shares directly and must instead instruct the broker how to vote your shares using the voting instruction form provided by the broker. When a beneficial owner of shares held by a bank, broker or other nominee fails to provide the record holder with voting instructions and such organization lacks the discretionary voting power to vote those shares with respect to a particular proposal, a “broker non-vote” (defined below) occurs.

What is a Broker Non-Vote?

If a Beneficial Owner does not provide timely instructions, the broker will not have the authority to vote on any non-routine proposals at the Annual Meeting, which includes proposals 1 and 2. Brokers will have discretionary authority to vote on proposal 3 because the ratification of the appointment of independent auditors is considered a routine matter. If the broker votes on proposal 3 (the advisory vote on ratification ofto ratify the selection of independent auditors), but does not vote on another proposal because the broker does not have discretionary voting authority and has not received instructions from the Beneficial Owner, this results in a “broker non-vote” with respect to proposals 1 and 2.such other proposal(s).

Broker non-votes on a matter may be counted as present for purposes of establishing a quorum for the meeting but are not considered entitled to vote on that particular matter. Consequently, broker non-votes generally will have no effect on the outcome of the matter. However, if and to the extent that broker non-votes are required to establish the presence of a quorum at the Annual Meeting, then any broker non-votes will have the same effect as a vote “Withheld” or “Against” any matter that requires approval of a majority of the minimum number of shares required to constitute a quorum for the transaction of business at the Annual Meeting.

What is the vote required to approve each proposal?

Assuming that a quorum is present to vote on each of the proposals, each of the proposals before the shareholders1, 2, and 3 will require the affirmative vote of holders of a majority of the shares represented and entitled to vote in person or by proxy on such action.

Please note that each of proposals 2 and 3 are “advisory” votes, meaning that the shareholder votes on these items are for purposes of enabling shareholders to express their point of view or preference on these proposals, but are not binding on the company or its boardBoard of directorsDirectors and do not require the company or its boardBoard of directorsDirectors to take any particular action in response to the shareholder vote. The Board intends to consider fully the votes of our shareholders in the context of any further action with respect to these proposals.

What constitutes a “quorum,” or how many shares are required to be present to conduct business at the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of common stock entitled to vote (i.e., at least 23,575,47515,063,637 shares) will constitute a quorum for the transaction of business at the Annual Meeting. In general, shares of common stock represented by a properly signed and returned proxy card or properly voted by telephone or via the Internet will be counted as shares represented and entitled to vote at the Annual Meeting for purposes of determining a quorum, without regard to whether the card reflects abstentions and withhold votes (or is left blank) or reflects a “broker non-vote” on a matter.

How do I vote my shares?

If you are aShareholder of Record as of the record date, you can give a proxy forvote your shares to be voted in any of the following ways:

| Over thetelephone by calling the toll-free number on the proxy card; |

| Over theInternet by following the instructions on the proxy card; |

| Through themail – if you received a paper copy of the |

| Over theInternet during the |

The telephone and Internet voting procedures have been set up for your convenience. We encourage you to save corporate expense by submitting your vote by telephone or Internet. The procedures have been designed to authenticate your identity, to allow you to give voting instructions, and to confirm that those instructions have been recorded properly.

If you are aBeneficial Owner of shares held in “street name,” you must vote your shares in the manner prescribed by your bank, broker or other nominee. Your bank, broker or other nominee has provided notice by email or a printed voting instruction card for you to use in directing the bank, broker or nominee how to vote your shares. Telephone and Internet voting are also encouraged for Beneficial Owners who hold their shares in street name.

Beneficial Owners should be aware that brokers are not permitted to vote shares on non-routine matters, including the election of directorsDirectors or matters related to executive compensation, without instructions from the Beneficial Owner. As a result, brokers are not permitted to vote shares on proposal 1 (election of directors)Directors) or proposal 2 (the advisory vote onto approve executive compensation), without instructions from the Beneficial Owner. Therefore, Beneficial Owners are advised that if they do not timely provide instructions to their bank, broker or other holder of record with respect to proposals 1 or 2, their shares will not be voted in connection with proposals 1 and 2.any such proposal for which they do not provide instructions. Proposal 3 (the advisory vote on ratification ofto ratify the selection of independent auditors) is considered a routine matter and, as such, brokers will still be able to vote shares held in brokerage accounts with respect to proposal 3, even if they do not receive instructions from the Beneficial Owner.

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote your shares in time for our May 16, 201615, 2019 meeting date.

How do I vote my shares in person at the meeting?

If you are aShareholder of Record and prefer to vote your shares at the meeting, bring the accompanying proxy card (if you received a paper copy of the proxy statement) and photo identification. If you are aBeneficial Owner holding shares in “street name,” such as through a bank, brokerage account, trust or other nominee, you may vote the shares at the meeting only if you obtain a signed proxy from the record holder (i.e., the bank, broker, trust or other nominee who is the record holder of the shares) giving you the right to vote the shares.

Even if you plan to attend the meeting, we encourage you to vote your shares in advance by Internet, telephone or mail so that your vote will be counted in the event you are unable to attend.

May I revoke a proxy and change my vote?

Yes. Any shareholder giving a proxy may revoke it at any time prior to its use at the Annual Meeting by:

| Delivering written notice of revocation to the Corporate Secretary before 6:00 p.m., Eastern Daylight Time, on May |

| Submitting to the Corporate Secretary before 6:00 p.m., Eastern Daylight Time, on May |

| Voting again by Internet or telephone before 11:59 p.m., Eastern Daylight Time, on May |

Attendance at the Annual Meeting will not, by itself, revoke your proxy. For shares you hold in street name, such as through a brokerage account, bank, trust or other nominee, you would need to obtain a legal proxy from your broker or nominee and bring it to the meeting in order to revoke a prior proxy and to vote those shares at the Annual Meeting. Prior to the meeting, you may revoke your proxy by contacting your broker or nominee and following their instructions for revoking your proxy.

Can I receive future proxy materials electronically?

Yes. If you are a Shareholder of Record and you received a paper copy of the proxy materials, you may elect to receive future proxy statementsProxy Statements and annual reports online as described in the next paragraph. If you elect this feature, you will receive an email message notifying you when the materials are available, along with a web address for viewing the materials. If you received this proxy statementProxy Statement electronically, you do not need to do anything to continue receiving proxy materials electronically in the future.

Whether you are a Shareholder of Record or a Beneficial Owner holding shares through a bank or broker, you can enroll for future electronic delivery of proxy statementsProxy Statements and annual reports by following these steps:

| Go to our website atwww.sleepnumber.com; |

| In theInvestor Relationssection, click onElectronic Fulfillment; |

| Click on the check-marked box next to the statement“Shareholders can register for electronic delivery of proxy-related materials.”; and |

| Follow the prompts to submit your request to receive proxy materials electronically. |

You may view this year’s proxy materials atwww.proxyvote.com.Generally, banks and brokers offering this choice require that shareholders vote through the Internet in order to enroll. Beneficial Owners whose bank or broker is not included in this website are encouraged to contact their bank or broker and ask about the availability of electronic delivery. As is customary with Internet usage, the user must pay all access fees and telephone charges. You may view this year’s proxy materials atwww.proxyvote.com.

What are the costs and benefits of electronic delivery of Annual Meeting materials?

There is no cost to you for electronic delivery of annual meeting materials. You may incur the usual expenses associated with Internet access as charged by your Internet service provider. Electronic delivery ensures quicker delivery, allows you to view or print the materials at your computer and makes it convenient to vote your shares online. Electronic delivery also conserves natural resources and saves the company printing, postage and processing costs.

Who bears the proxy solicitation costs?

The proxies being solicited hereby are being solicited by the Board of Directors of the company. The cost of preparing and mailing the notice of Annual Meeting, this proxy statementProxy Statement and the accompanying proxy and the cost of solicitation of proxies on behalf of the Board of Directors will be borne by the company. The company may solicit proxies by mail, internetInternet (including by email, Twitter, the use of our investor relations website and other online channels of communication), telephone, facsimile and other electronic channels of communication, town hall meetings, personal interviews, press releases, and press interviews. Our directors,Directors, officers and regular employeesteam members may, without compensation other than their regular compensation and the reimbursement of expenses, solicit proxies by telephone or personal conversation. In addition, we may reimburse brokerage firms and others for their reasonable and documented expenses incurred in connection with forwarding proxy materials to the Beneficial Owners of our common stock.

7

STOCK OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table shows the beneficial ownership of Select ComfortSleep Number common stock as of February 27, 201623, 2019 (unless another date is indicated) by (a) each director,Director, each nominee for directorDirector recommended by our Board and each executive officer named in the Summary Compensation Table on page 5051 of this Proxy Statement, (b) all directorsDirectors and executive officers as a group and (c) each person known by us to be the Beneficial Owner of more than 5% of Select ComfortSleep Number common stock.

| Title of Class | Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2) | Percent of Class | Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2)(3) | Percent of Class |

| Common Stock | Daniel I. Alegre | 11,250 | * | Daniel I. Alegre | 24,965 | * |

| Common Stock | Andrea L. Bloomquist(3) | 63,528 | * | Andrea L. Bloomquist | 121,580 | * |

| Common Stock | David R. Callen | 17,699 | * | Kevin K. Brown | 47,482 | * |

| Common Stock | Andrew P. Carlin(4) | 56,346 | * | David R. Callen | 75,792 | * |

| Common Stock | Stephen L. Gulis, Jr. (5) | 126,413 | * | Andrew P. Carlin | 75,303 | * |

| Common Stock | Michael J. Harrison(5) | 33,720 | * | Stephen L. Gulis, Jr.(4) | 89,118 | * |

| Common Stock | Shelly R. Ibach(6) | 285,003 | * | Michael J. Harrison(4) | 47,435 | * |

| Common Stock | David T. Kollat | 174,744 | * | Shelly R. Ibach | 449,880 | 1.5% |

| Common Stock | Brenda J. Lauderback(5) | 81,095 | * | Deborah L. Kilpatrick, Ph.D. | 1,376 | * |

| Common Stock | Barbara R. Matas(7) | --- | * | Brenda J. Lauderback(4) | 47,490 | * |

| Common Stock | Kathleen L. Nedorostek(5) | 32,749 | * | Barbara R. Matas(4) | 16,766 | * |

| Common Stock | Vicki A. O’Meara(7) | --- | * | Kathleen L. Nedorostek(4) | 43,965 | * |

| Common Stock | Michael A. Peel(5) | 119,509 | * | Vicki A. O’Meara | 9,845 | * |

| Common Stock | Kathryn V. Roedel(8) | 183,523 | * | Michael A. Peel(4) | 112,898 | * |

| Common Stock | Jean-Michel Valette | 279,771 | * | Jean-Michel Valette | 281,486 | * |

| Common Stock | All directors and executive officers as a group (20 persons)(9) | 1,804,992 | 3.7% | All directors and executive officers as a group (20 persons)(5) | 1,749,142 | 5.6% |

| Common Stock | BlackRock, Inc.(10) 55 East 52nd Street New York, New York 10022 | 4,862,132 | 10.2% | BlackRock, Inc.(6) 55 East 52nd Street New York, New York 10055 | 4,772,079 | 15.7% |

| Common Stock | The Vanguard Group, Inc.(11) 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | 3,936,723 | 8.2% | Disciplined Growth Investors, Inc.(7) 150 South Fifth Street, Suite 2550 Minneapolis, Minnesota 55402 | 3,603,954 | 11.9% |

| Common Stock | Disciplined Growth Investors, Inc.(12) 150 South Fifth Street, Suite 2100 Minneapolis, Minnesota 55402 | 3,716,397 | 7.8% | The Vanguard Group, Inc.(8) 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | 3,394,508 | 11.2% |

| Common Stock | Columbia Wanger Asset Management, LLC(13) 227 West Monroe Street Suite 3000 Chicago, Illinois 60606 | 2,957,480 | 6.2% | Vulcan Value Partners, LLC(9) 2801 Highway 280 South, Suite 300 | 2,716,036 | 9.0% |

| Common Stock | FMR LLC(14) 245 Summer Street Boston, Massachusetts 02210 | 2,776,051 | 5.8% | Dimensional Fund Advisors LP(10) 6300 Bee Cave Road, Building One | 1,755,694 | 5.8% |

| Common Stock | AllianceBerstein L.P.(15) 1345 Avenue of the Americas New York, New York 01015 | 2,651,958 | 5.6% | |||

* Less than 1% of the outstanding shares.

| (1) | The business address for each of the |

| (2) | The shares shown include the following shares that |

| (3) | The shares shown |

| (4) |

| The Amended and Restated 2010 Omnibus Plan (the Plan) permits non-employee |

| Includes an aggregate of |

| BlackRock, Inc. reported in a Schedule |

| Disciplined Growth Investors, Inc. reported in a Schedule 13F filed with the Securities and Exchange Commission on February 13, 2019 that as of December 31, 2018 it beneficially owned 3,603,954 shares of Common Stock of Sleep Number Corporation, had sole dispositive power with respect to 3,603,954 shares, sole power to vote or to direct the vote with respect to 2,994,791 shares and no voting power with respect to 609,163 shares. |

| (8) | The Vanguard Group, Inc. reported in a Schedule 13G/A filed with the Securities and Exchange Commission on February |

(Proposal 1)

Nomination

Article XIV of our Third Restated Articles of Incorporation provides that the number of directorsDirectors must be at least one but not more than 12 and must be divided into three classes as nearly equal in number as possible. The exact number of directorsDirectors is determined from time-to-time by the Board of Directors. The term of each class is three years and the term of one class expires each year in rotation.

On March 15, 2016, we announced that Vicki A. O’Meara and Barbara R. Matas were appointed to serve on our Board of Directors effective as of April 25, 2016. Ms. Matas was appointed to the class of directors serving for a term expiring at the 2016 Annual Meeting of Shareholders. Ms. O’Meara was appointed to the class of directors serving for a term expiring at the 2017 Annual Meeting of Shareholders and is expected to stand for election at that meeting for a three-year term expiring at the 2020 Annual Meeting of Shareholders.

Immediately prior to the 20162019 Annual Meeting, our Board will consist of 11 members. David T. Kollat plans to retire from the Board when his term expires at the 2016 Annual Meeting and our Board will thereafter consist of 10 members, threefour of which will be up for election at the 20162019 Annual Meeting. The Board has nominatedMichael J. Harrison, Shelly R. Ibach, Deborah L. Kilpatrick, Ph.D., and Barbara R. Matasfor election to the Board, each for a term of three years expiring at the 20192022 Annual Meeting, or until their successors are elected and qualified. Mr. Harrison, Ms. Ibach, Ms. Kilpatrick and Ms. Matas have each consented to being named as a nominee in this proxy statementProxy Statement and to serve as a directorDirector if elected. Mr. Harrison has served on our Board since 2011; Ms. Ibach has served on our Board since 2012; Ms. Kilpatrick has served on our Board since 2018; and Ms. Matas was appointed tohas served on our Board effectivesince 2016. As previously announced, in light of her increasing professional commitments, Vicki O’Meara will be retiring from the Board following the Annual Meeting. The Company thanks Ms. O’Meara for her service and dedication during her tenure as a member of April 25, 2016.the Board.

Vote Required

The election of each nominee for directorDirector requires the affirmative vote of a majority of the shares represented and entitled to vote on the election of directorsDirectors at the Annual Meeting. Any broker non-votes on the election of each nominee for directorDirector will be treated as shares not entitled to vote on that matter, and thus will not be counted in determining whether the directorDirector has been elected.

Board Recommendation

The Board recommends a vote “For” the election of each of Mr. Harrison, Ms. Ibach, Ms. Kilpatrick and Ms. Matas. In the absence of other instructions, properly signed and delivered proxies will be voted “For” the election of each of these nominees.

If prior to the Annual Meeting the Board should learn that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for such nominee will be voted for such substitute nominee as selected by the Board. Alternatively, the proxies, at the Board’s discretion, may be voted for such fewer number of nominees as results from the inability of any such nominee to serve. The Board has no reason to believe that any of the nominees will be unable to serve.

Information about the Board’s Nominees and Other Directors

The following table provides information as of the date of this Proxy Statement about each individual serving as a Director of our company and each individual nominated by the Board to serve as a Director. Each Director or Nominee has furnished the information included below that relates to his or her respective age, principal occupation and business experience, as well as the names of other boards on which he or she currently serves as a directorDirector or has served in the past. In addition, the table below highlights the relevant experience, qualifications, attributes and skills that led our Board to conclude that each directorDirector or nominee shouldis qualified to serve as a directorDirector of our company.

Name and Age of | Principal Occupation, Business Experience and Directorships of Other Companies | Director Since | ||||||

Nominees for election this year to three-year terms expiring in | ||||||||

Michael J. Harrison Age | Occupation:Board Director since January 2016, and previously interim CEO from March 2014 to May 2015, of OOFOS, | 2011 | ||||||

| Qualifications:Mr. Harrison brings 30 years of business acumen to our Board from his senior executive experience in marketing, product design and development, retailing and international management with leading consumer brands. | ||||||||

Other Company Boards (privately held):

| ||||||||

Name and Age of Nominee and/or Director | Principal Occupation, Business Experience and Directorships of Other Companies | Director Since |

Shelly R. Ibach Age | Occupation:President and Chief Executive Officer of | 2012 | ||

| Qualifications:Ms. Ibach brings leadership, experience and perspective as | ||||

Deborah L. Kilpatrick, Ph.D. Age 51 | Occupation: Chief Executive Officer of Evidation Health, Inc., a digital health company, since 2014; Vice President of Market Development and Chief Commercial Officer of CardioDx, a genomic diagnostics company from 2006 to 2014 with responsibility for sales, marketing, and reimbursement from insurers; Held multiple leadership roles at Guidant Corporation, a medical device company, from 1998 to 2006 (acquired by Boston Scientific), including Research Fellow, Director of R&D, and Director of New Ventures in the Vascular Intervention Division; Serves on the College of Engineering Advisory Boards for Georgia Tech and the California Polytechnic State University, and is a Fellow of the American Institute of Medical and Biological Engineering; Holds multiple patents in medical device technologies and drug delivery devices; Advises multiple venture capital funds and privately-held startup companies in the digital health and health care sectors. | 2018 | ||

Name and Age of | Principal Occupation, Business Experience and Directorships of Other Companies | Director Since | ||

| Qualifications: Ms. Kilpatrick brings to our Board substantial expertise and experience in the development and commercialization of digital health products, and a track record of successful product innovation to transform health care with big data in the genomic and digital era. With her deep understanding of digital health opportunities and passion for our sleep innovations, Ms. Kilpatrick’s appointment to our Board supports our strategy of improving lives through individualizing sleep experiences and advancement of our SleepIQ technology platform. | ||||

Other Company Boards (privately held): Current: Evidation Health, Inc.; NextGen Jane, Inc. | ||||

Barbara R. Matas Age | Occupation:Former Managing Director and Chairman, Leveraged Finance, Citigroup Global Markets, Inc. from 2013 to 2016, and co-head from 2006 to 2013; From 1985 to 2006 Ms. Matas held various leadership positions in leveraged finance and high yield capital markets at Citicorp, Salomon Brothers and Citigroup; Ms. Matas began her career as an auditor at Touche Ross & Co. | |||

| Qualifications:Ms. Matas brings to our board substantial expertise in capital structure and financial strategy gained through more than 30 years of professional experience in advising boards and management teams on capital markets, capital structure and risk assessment and management. | ||||

Other Public Company Boards: Current: Apollo Investment Corporation | ||||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE | ||||

Name and Age of | Principal Occupation, Business Experience and Directorships of Other Companies | Director Since | ||||||

Directors not standing for election this year whose terms expire in | ||||||||

Kathleen L. Nedorostek Age | Occupation: Former Global CEO of Nine West Group, a division of Nine West Holdings, Inc., a leading global designer, marketer and wholesaler of brands in apparel, footwear and accessories from April 2014 to September 2014; Group President, Global Footwear and Accessories at The Jones Group from October 2012 until April 2014; President of the North American Wholesale and Global Licensing divisions of Coach Inc. from 2003 to 2012. | 2011 | ||||||

| Qualifications:Ms. Nedorostek provides our Board with significant experience leading high-end, multi-national branded consumer products companies with both manufacturing and retail operations. Her experience includes strategic planning for global businesses, P&L oversight, organizational strategy and change management, product design, global licensing and distribution, brand marketing and real estate. | ||||||||

Vicki A. O’Meara Age | Occupation: Executive Chairman and Board Chair, AdSwerve, Inc., a marketing technology company, since 2018; Former Chief Executive Officer, | |||||||

| Qualifications:Ms. O’Meara brings to our Board extensive global leadership and operational experience in a variety of functional areas relevant to our business and strategic direction, including supply chain, digital analytics, marketing, corporate governance, environmental health and safety and government affairs. Ms. O’Meara also brings experience from prior service on two public company boards. | ||||||||

Name and Age of Nominee and/or Director | Principal Occupation, Business Experience and Directorships of Other Companies | Director Since | ||

Other Company Boards: Current: State Farm Mutual Automobile Insurance Company (privately held mutual company) Prior: Health Management Associates, Inc. and Laidlaw, Inc. | ||||

Michael A. Peel Age 69 | Occupation: Currently serves as Senior Advisor to the leadership advisory firm ghSMART and is Managing Partner of Peel Global Advisory, LLC; Previously served as a Senior Officer of Yale University from October 2008 until his retirement in July 2017, including most recently as Chief Human Resources and Administration Officer; Prior to joining Yale, Mr. Peel spent 17 years as a member of the top management team at General Mills, Inc., a manufacturer and marketer of consumer food products, including serving as Executive Vice President of Human Resources & Global Business Services; Also, Mr. Peel had 14 years of experience at PepsiCo, Inc., including serving as Chief Human Resources Officer for two of its largest operating divisions, PepsiCo Worldwide Foods and Pepsi-Cola Bottling Group. | 2003 | ||

| Qualifications: Mr. Peel is a widely recognized Human Resources expert with extensive experience in large, consumer-oriented and publicly traded companies. He has extensive international operating and merger/acquisition/joint venture experience. He provides our Board with senior level perspective on organizational effectiveness, talent development, change management, succession planning, and executive compensation. | ||||

Other Public Company Boards: | ||||

| ||||

Current: Pier 1 Imports, Inc. |

Name and Age of | Principal Occupation, Business Experience and Directorships of Other Companies | Director Since | ||

Jean-Michel Valette Age | Occupation:Chairman of our Board since May 2010; Independent adviser to branded consumer companies; Currently serves as Lead Director of The Boston Beer | 1994 | ||

| Qualifications:Mr. Valette provides our Board with significant, relevant leadership and a proven track record of significant long-term shareholder value creation with multiple successful branded consumer growth companies as well as valuable perspective in guiding the company on strategy, financial performance and corporate governance practices. | ||||

Other Public Company Boards: | ||||

| Current: | Lead Director of The Boston Beer Company | |||

| Non-Executive Director, Intertek Group plc | ||||

| Prior: | Peet’s Coffee and Tea, Inc., Golden State Vintners | |||

| Directors not standing for election this year whose terms expire in | |||||||

Daniel I. Alegre Age | Occupation:President of | ||||||

Name and Age of | Principal Occupation, Business Experience and Directorships of Other Companies | Director Since | ||

| Qualifications:Mr. Alegre provides | ||||

Stephen L. Gulis, Jr. Age | Occupation: | 2005 | ||||||

| Qualifications:Mr. Gulis provides | ||||||||

Other Public Company Boards: Current: Independent Bank Corporation

| ||||||||

Brenda J. Lauderback Age | Occupation:Former President of the Retail and Wholesale Group for the Nine West Group, Inc., a designer and marketer of women’s footwear and accessories, from May 1995 until January 1998; Previous roles include President of Wholesale and Manufacturing for US Shoe Corporation and more than 18 years in senior merchandising roles at the Department Store Division of Target Corporation. | 2004 | ||||||

Name and Age of | Principal Occupation, Business Experience and Directorships of Other Companies | Director Since | ||

| Qualifications:Ms. Lauderback | ||||

Other Public Company Boards: Current: Denny’s Corporation and Prior: Big Lots, Inc., Louisiana-Pacific Corporation, Irwin Financial Corporation, Jostens Corporation |

Corporate Governance

Information about the Board of Directors and its Committees

The Board of Directors has determined that each of the following directorsDirectors who either served as a member of our Board during any part of fiscal 2015 or has been appointed to our Board during 20162018 is an “independent director”Director” as defined by applicable rules of the NASDAQNasdaq Stock Market and the rules and regulations of the Securities and Exchange Commission (“SEC”):

| Daniel I. Alegre | Stephen L. Gulis, Jr. | Michael J. Harrison | |

| Brenda J. Lauderback | Barbara R. Matas | ||

| Kathleen L. Nedorostek | Vicki A. O’Meara | Michael A. Peel | |

| Jean-Michel Valette |

The Board maintains three standing committees, including an Audit Committee, a Management Development and Compensation Committee and a Corporate Governance and Nominating Committee. Each of the committees of the Board has a charter and each of these charters is included in the investor relations section of the company’s website athttp://www.sleepnumber.com/sn/en/investor-relations.investor-relations. The information contained in or connected to our website is not incorporated by reference into or considered a part of this Proxy Statement.

The current members of each of the Board committees are identified in the table below. In his capacity as non-executive Chairman of the Board, Mr. Valette may attend and vote at any committee meeting.

Director | Audit

Committee | Management Development and Compensation Committee | Corporate Governance and Nominating Committee | ||||

| Daniel I. Alegre | X | ||||||

| Stephen L. Gulis, Jr. | |||||||

| X | X | ||||||

| X | X | ||||||

| X | |||||||

| Brenda J. Lauderback | Chair | ||||||

| Barbara R. Matas | Chair | ||||||

| Kathleen L. Nedorostek | X | X | |||||

| Vicki A. O’Meara | X | ||||||

| Michael A. Peel | Chair | ||||||

| Jean-Michel Valette* |

Table*In his capacity as non-executive Chairman of Contents

Upon their appointment to the Board, effective as of April 25, 2016, each of Barbara R. Matas and Vicki A. O’Meara will also serve on the Audit Committee. In connection with the Annual Meeting of Shareholders in May of 2016, the Board intends to review and reconfigure Board Committee assignments.Mr. Valette generally attends all committee meetings.

The Board has determined that each directorDirector serving on a committee meets the independence and other requirements applicable to such committee prescribed by applicable rules and regulations of the NASDAQNasdaq Stock Market, the SEC and the Internal Revenue Service.

The Board of Directors has further determined that two current members of the Audit Committee, Stephen L. Gulis, Jr. and Jean-Michel Valette, as well as Barbara R. Matas, upon her appointment to the Board and Audit Committee effective as of April 25, 2016, meet the definition of “audit committee financial expert” under rules and regulations of the SEC and meet the qualifications of “financial sophistication” under the Marketplace Rules of the NASDAQNasdaq Stock Market. These designations related to our Audit Committee members’ experience and understanding with respect to certain accounting and auditing matters are disclosure requirements of the SEC and the NASDAQNasdaq Stock Market and do not impose upon any of them any duties, obligations or liabilities that are greater than those generally imposed on a member of our Audit Committee or of our Board of Directors.

The Board of Directors met in person or by telephone conference ninefive times during 2015.2018. The Audit Committee met in person or by telephone conference eight times during 2015.2018. The Management Development and Compensation Committee met in person or by telephone conference five times during 2015.2018. The Corporate Governance and Nominating Committee met in person or by telephone conference fiveseven times during 2015. All2018. Each of the members of our Board of Directors serving in 20152018 attended 75% or more of all meetings of the Board and committees on which they served during fiscal 2015.2018.

19

Audit Committee. The Audit Committee is comprised entirely of independent directors,Directors, currently including Barbara R. Matas (Chair), Stephen L. Gulis, Jr. (Chair), Michael J. Harrison, Brenda J. Lauderback, KathleenDeborah L. NedorostekKilpatrick, Ph.D. and Jean-Michel Valette.Vicki A. O’Meara. The Audit Committee provides assistance to the Board in satisfying its fiduciary responsibilities relating to accounting, auditing, operating and reporting practices of our company. The Audit Committee is responsible for providing independent, objective oversight with respect to our company’s accounting and financial reporting functions, internal and external audit functions, systems of internal controls regarding financial matters and legal, ethical and regulatory compliance. The responsibilities and functions of the Audit Committee are further described in the Audit Committee Report beginning on page 6365 of this Proxy Statement.

Management Development and Compensation Committee. The Management Development and Compensation Committee is comprised entirely of independent directors,Directors, currently including Brenda J. Lauderback (Chair), Daniel I. Alegre, David T. KollatMichael J. Harrison and Michael A. Peel.Kathleen L. Nedorostek. The principal function of the Committee is to discharge the responsibilities of the Board relating to executive compensation and development of current and future leadership resources.

The Committee has the authority under its charter to retain and consult with independent advisors to assist the Committee in fulfilling these responsibilities and duties.

The Committee usually meets four to six times per year in person or by telephone conference as needed. The Chairman of the Committee works with members of our senior management team and with the Committee’s independent compensation consultant to determine the agenda for each meeting.

At the beginning of each fiscal year, the Committee reviews and approves compensation for the CEO and each of the other executive officers, which generally includes:

In connection with this review and approval, the independent compensation consultant provides relevant market data and trends for the Committee to consider, and the Committee compares each element of total compensation against this market data as it makes compensation decisions.

Following the end of each fiscal year, the Committee reviews and confirms the level of achievement of performance goals previously established for the fiscal year and approves any resulting annual cash incentive or performance share payouts that may be applicable.

Also on an annual basis, the Committee leads the Chief Executive Officer performance evaluation process and reviews the development and succession plans with respect to the entire executive team.

The responsibilities and functions of the Management Development and Compensation Committee, as well as its processes and procedures for consideration and determination of executive and directorDirector compensation, are further described in the Compensation Discussion and Analysis beginning on page 2930 of this Proxy Statement.

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee is comprised entirely of independent directors,Directors, currently including Michael A. Peel (Chair), Stephen L. Gulis, Jr., Michael J. Harrison and Kathleen L. Nedorostek. The primary functions of the Corporate Governance and Nominating Committee are to develop and recommend to the Board corporate governance principles to govern the Board, its committees, and our executive officers and employeesteam members in the conduct of the business and affairs of our company; to identify and recommend to the Board individuals qualified to become members of the Board and its committees; and to develop and oversee the annual Board and Board committee evaluation process.

Board Leadership Structure

Our Board is currently comprised of eight10 independent directorsDirectors and one executive director,Director, Shelly R. Ibach, who has served as our President and Chief Executive Officer since June 2012. Two additional independent directors have been appointed to serve on the Board effective as of April 25, 2016. Since February 2008, the Board has determined to separate the positions of Chairman of the Board and Chief Executive Officer. Based on its ongoing review of best practices in corporate governance, and to enable the President and Chief Executive Officer to focus all of her time and energy in leadership of the day-to-day operations of the company and its growth and profitability initiatives, the Board continues to believe it is best for the company to separate these positions. Jean-Michel Valette, an independent director,Director, has served as Chairman of the Board since May 2010.

Consistent with the company’s Corporate Governance Principles, the Board retains the right to review this determination and to either continue to maintain these positions as separated positions or to combine the positions, as the Board determines to be in the best interests of the company at the time. Under the company’s Corporate Governance Principles, during any period in which the positions of Chairman of the Board and Chief Executive Officer are combined, the Board would appoint a Lead Director from among the independent members of the Board, who would have certain Board leadership responsibilities specified in our Corporate Governance Principles.

Board Role in Risk Oversight

Our Board is responsible for overseeing the company’s policies and practices with respect to risk assessment and risk management and has delegated to the Audit Committee the responsibility of assisting the Board in fulfilling this role. Among its duties and processes, the Audit Committee (a) reviews and discusses with management the company’s policies and practices with respect to risk assessment and risk management; (b) oversees the company’s internal audit function and processes; (c) establishes and oversees procedures for receiving and addressing complaints regarding accounting, internal controls or auditing matters; (d) reviews legal compliance and other legal matters with the company’s counsel; and (e) reports to the full Board with respect to matters within its area of responsibility.

The Audit Committee oversees the company’s internal audit function, which is responsible for undertaking an annual risk assessment process and reporting to the Audit Committee with respect to this assessment and related risk management strategies. The Audit Committee reviews and approves, at least annually, the company’s internal audit plan and receives quarterly reports with respect to the results of internal audits. The leader of the company’s internal audit function reports directly to the Audit Committee with respect to internal audit matters, and the Audit Committee has authority to review and approve the appointment, replacement or dismissal of the leader of this function. The leader of the internal audit function meets regularly in executive session with the Audit Committee without any other members of the company’s management team present.

In addition to the Audit Committee’s role, each of the other committees considers risks within its respective areas of responsibility. We believe our current Board leadership structure helps ensure proper risk oversight, based on the allocation of duties among committees and the role of our independent directorsDirectors in risk oversight.

Director Nominations Process

The Corporate Governance and Nominating Committee (the “CGNC”) administers the process for nominating candidates to serve on our Board of Directors. The CGNC recommends candidates for consideration by the Board as a whole, which is responsible for appointing candidates to fill any vacancy that may be created between meetings of the shareholders and for nominating candidates to be considered for election by shareholders at our Annual Meeting.

Consistent with the company’s Corporate Governance Principles, the CGNC periodically reviews with the Board the appropriate skills and characteristics required of Board members in the context of the current membership of the Board and the strategic direction of the company.

The Board has established selection criteria to be applied by the CGNC and by the full Board in evaluating candidates for election to the Board. These criteria include general characteristics, areas of specific expertise and experience, and considerations of diversity. The general characteristics include:

| Independence; |

| Integrity; |

| A proven record of accomplishment and sound judgment in areas relevant to our business; |

| Belief in and passion for our mission and vision; |

| The ability to bring strategic and innovative insights to the discussion and challenge and stimulate management; |

| Willingness to both speak one’s |

| Understanding of, and ability to commit sufficient time to, Board responsibilities and duties; and |

| Subject matter expertise. |

The specific areas of expertise and experience sought by the CGNC and the Board from time to time will vary depending on the composition of the Board and the strategic direction of the company, at the time, but will generally include CEO experience, executive level experience with analogous businesses and industries, and functional expertise relevant to the strategic direction of the company or the needs of the committees of the Board.

The directorDirector nomination process specifically includes consideration of diversity, such as diversity of age, gender, race and national origin, educational and professional experience and differences in viewpoints. The CGNCcompany does not have a formal policy with respect to diversity; however,diversity. However, the CGNC considers Director candidates in the context of the Board’s overall composition, including whether the Board has an appropriate combination of professional experience, skills, knowledge and variety of viewpoints and backgrounds in light of the company’s current and expected future needs. In addition, the CGNC believealso believes that it is essential thatdesirable for new candidates to contribute to a variety of viewpoints on the Board, members represent diverse perspectives.

which may be enhanced by a mix of different professional and personal backgrounds and experiences. Currently, six of our 11 Directors are women.

The CGNC reviews these selection criteria and the overall directorDirector nomination process at least annually in connection with the nomination of directorsDirectors for election at the company’s annual meeting for consistency with best practices in corporate governance and effectiveness in meeting the needs of the Board from time-to-time.

The CGNC may use a variety of methods for identifying potential nominees for election to the Board, including consideration of candidates recommended by directors,Directors, officers or shareholders of the company. The CGNC also has the authority under its charter to engage professional search firms or other advisors to assist the CGNC in identifying candidates for election to the Board, or to otherwise assist the CGNC in fulfilling its responsibilities.

Shareholder nominations of candidates for membership on the Board submitted in accordance with the terms of our Bylaws will be reviewed and evaluated by the CGNC in the same manner as for any other nominations. Any shareholder who wishes the CGNC to consider a candidate should submit a written request and related information to our Corporate Secretary. Under our Bylaws, if a shareholder intends to nominate a person for election to the Board of Directors at a shareholder meeting, the shareholder is required to give written notice of the proposed nomination to the Corporate Secretary at least 120 days prior to the first anniversary of the date that the company first released or mailed its proxy materials to shareholders in connection with the preceding year’s regular or annual meeting. The shareholder’s notice must include, for each nominee whom the shareholder proposes to nominate for election as a director:Director: (i) the name, age, business address and residence address of the nominee, (ii) the principal occupation or employment of the nominee, (iii) the class and number of shares of capital stock of the company that are beneficially owned by the nominee, and (iv) any other information concerning the nominee that would be required under the rules of the Securities and Exchange Commission in a proxy statement soliciting proxies for the election of such nominee. The shareholder’s notice must also include: (i) the name and address of the nominating shareholder, as they appear on the company’s books, and (ii) the class and number of shares of the company that are owned beneficially and of record by the shareholder. The shareholder’s notice must also be accompanied by the proposed nominee’s signed consent to serve as a directorDirector of the company.

Shareholder Communications with the BoardEngagement

Our Board of Directors and management team maintain a deep commitment to strong corporate governance. Engagement with, and accountability to, our shareholders are cornerstones of this commitment. Accordingly, we maintain an active shareholder engagement program that facilitates channels of communication and aims to foster relationships with our shareholders to drive sustainable, long-term growth and shareholder value. As part of our engagement program, members of our management team and the Chairman of the Board of Directors regularly meet with shareholders, in-person or by phone, to discuss strategy, governance, pay for performance orientation, and other matters of shareholder interest. Our ongoing shareholder engagement and commitment to long-term value creation will continue to inform the Board of Director’s deliberations in 2019 and beyond.

Shareholders may communicate with the Board of Directors, its Committees or any individual member of the Board of Directors by sending a written communication to our Corporate Secretary at 9800 59th1001 Third Avenue North, Plymouth,South, Minneapolis, MN 55442.55404. The Corporate Secretary will promptly forward any communication so received to the Board, any Committee of the Board or any individual Board member specifically addressed in the communication. In addition, if any shareholder or other person has a concern regarding any accounting, internal control or auditing matter, the matter may be brought to the attention of the Audit Committee, confidentially and anonymously, by calling 1-800-835-5870, inserting the I.D. Code of AUDIT (28348) and following the prompts from the recorded message. The company reserves the right to revise or make exceptions to this policy in the event that the process is abused, becomes unworkable or otherwise does not efficiently serve the purposes of the policy.

Policy Regarding Director Attendance at Annual Meeting

Our policy is to require attendance by all of our directorsDirectors at our Annual Meeting of Shareholders, except for absences due to causes beyond the reasonable control of the director.Director. All of the directorsDirectors then serving on our Board were in attendance at our 20152018 Annual Meeting of Shareholders.

Corporate Governance Principles

Our Board of Directors has adopted Corporate Governance Principles that were originally developed and recommended by the Corporate Governance and Nominating Committee.CGNC. These Corporate Governance Principles are available in the investor relations section of the company’s website athttp://www.sleepnumber.com/sn/en/investor-relations. The information contained in or connected to our website is not incorporated by reference into or considered a part of this Proxy Statement. Among these Corporate Governance Principles are the following:

Independence. A substantial majority of the members of the Board should be independent, non-employee directors.Directors. It is the responsibility of the Board to establish the standards for independence, and the Board has followed the independence standards for companies listed on The NASDAQNasdaq Stock Market. All of our directorsDirectors are independent except our Chief Executive Officer, Shelly R. Ibach. All Committees of the Board are composed entirely of independent directors.Directors.

Chairman and Chief Executive Officer Positions. At the present time, the Board believes that it is in the best interests of the company and its shareholders for the positions of Chairman of the Board and Chief Executive Officer to be separated, and for the position of Chairman of the Board to be held by a non-executive, independent member of the Board. The Board retains the right to review this determination and to either continue to maintain these positions as separated positions or to combine the positions, as the Board determines to be in the best interests of the company at the time. During any period in which the positions of Chairman of the Board and Chief Executive Officer are combined, the Board will appoint a Lead Director from among the independent members of the Board.

Classified Board Structure. Our Third Restated Articles of Incorporation provide for a classified Board serving staggered terms of three years each. The Board will periodically review its classified Board structure in the context of other provisions and measures applicable to unsolicited takeover proposals with the objective of positioning the Board and the company to maximize the long-term value of our company for all shareholders.

Majority Voting Standard with Resignation Policy for Board Elections. Our Third Restated Articles of Incorporation provide for a majority voting standard in the case of uncontested elections of directorsDirectors and a plurality voting standard in the case of contested elections of directorsDirectors in order to reduce the risk of a “failed election” in the context of a contested directorDirector election.

Requirement of Incumbent Directors who do not Receive a Majority Vote in an Uncontested Election to Tender Resignation. If a nominee for Director who is an incumbent Director is not elected at a meeting of shareholders and no successor to the incumbent Director is elected at the meeting of shareholders, the incumbent Director shall promptly offer to tender his or her resignation to the Board. The Corporate Governance and Nominating CommitteeCGNC shall make a recommendation to the Board on whether to accept or reject the offer, or whether other action should be taken. The Board shall act on whether to accept the Director’s offer, taking into account the Corporate Governance and Nominating Committee’sCGNC’s recommendation, and publicly disclose (by press release, a filing with the Securities and Exchange CommissionSEC or other broadly disseminated means of communication) its decision and the supporting rationale within 90 days after the date of the certification of the election results. The Corporate Governance and Nominating Committee,CGNC, in making its recommendation, and the Board, in making its decision, may each consider any factors or other recommendations that it considers relevant and appropriate. The incumbent Director who offers to tender his or her resignation shall not participate in the Board’s decision. If such incumbent Director’s offer to tender his or her resignation is not accepted by the Board, such Director shall continue to serve until his or her successor is duly elected, or his or her earlier death, resignation, retirement, disqualification or removal.

Board DiversityDiversity.. The company does not have a formal policy with respect to diversity. Instead,However, the CGNC considers Director candidates in the context of the Board’s overall composition, when considering Director candidates, including whether the Board has an appropriate combination of professional experience, skills, knowledge and variety of viewpoints and backgrounds in light of the company’s current and expected future needs. In addition, the CGNC Committee also believes that it is desirable for new candidates to contribute to a variety of viewpoints on the Board, which may be enhanced by a mix of different professional and personal backgrounds and experiences.

Approach to Term and Age Limits. The Board has determined to not adoptWe believe that specific or fixed term or age limits in ordercould cause the company to not arbitrarily lose important contributors to the Board. In order to ensure an appropriate balance between new perspectives and experienced Directors, ifIt is the median tenuresense of the Board, exceeds 8.5 yearshowever, that a Director who reaches the age of 72 should promptly tender his or ifher resignation to the majorityChair of the Directors are 60 years of age or older, thenCGNC, and the Board may consider alternativesshould have an opportunity to achieve an appropriate balancereview the qualifications of new perspectivesthe Director for continued Board membership. The CGNC will review the qualifications of the Director for continued Board membership annually and experienced directors onmake a recommendation to the Board over the ensuing years. Such alternatives may be considered in the context of an evaluation of the Board’s needs at the time and into the future and individual Directors’ contributionseach year, which will make a final determination with respect to the Board.tendered resignation.

Change in Responsibilities. The Board does not believe that Directors who retire or who have a change in their principal employment or affiliation after joining the Board should not necessarily leave the Board. There should, however, be an opportunity for the Board through the Corporate Governance and Nominating Committee, to review the qualifications of the directorDirector for continued Board membership. Any Director who undergoes a material change in principal employment or affiliation is requiredwill promptly tender his or her resignation to promptly notify the Chair of the Corporate Governance and Nominating CommitteeCGNC. The CGNC will review the qualifications of the change.Director for continued Board membership and make a recommendation to the Board, which will make a final determination with respect to the tendered resignation.

Other Board or Audit Committee Service. The Board recognizes that service on other boards can in some circumstances limit the time that Directors may have to devote to fulfilling their responsibilities to the company. It is the Board’s guideline that no Director shall serve on more than a total of six public company boards (including the Select ComfortSleep Number Board), and that no member of the company’s Audit Committee shall serve on more than a total of three public company audit committees (including the Select ComfortSleep Number Audit Committee). If any Director exceeds or proposes to exceed these guidelines, the Director is required to promptly notify the Chair of the Corporate Governance and Nominating CommitteeCGNC and the committee will review the facts and circumstances and determine whether such service would interfere with the Director’s ability to devote sufficient time to fulfilling the Director’s responsibilities to the company. Currently, none of the Directors serve on more than three public company boards, including the Sleep Number Board.

Chief Executive Officer Service on Other Boards. The Chief Executive Officer shallmay not serve on more than two public company boards other than the Sleep Number Board of Directors of the company.Directors.

Board and Committee Evaluations. The Board believes that the company’s governance and the Board’s effectiveness can be continually improved through evaluation of both the Board as a whole and its committees. The Corporate Governance and Nominating CommitteeCGNC is responsible for annually evaluating effectiveness in these areas and reviewing the results and recommendations for improvement with the full Board.

Board Executive Sessions. Executive sessions or meetings of independent directorsDirectors without management present will be held at least twice each year. At least one session will be to review the performance criteria applicable to the Chief Executive Officer and other senior managers,executive officers, the performance of the Chief Executive Officer against such criteria, and the compensation of the Chief Executive Officer and other senior managers.executive officers. Additional executive sessions or meetings of outside directorsindependent Directors may be held from time-to-time as required. The Board’s practice has been to meet in executive session for a portion of each regularly scheduled meeting of the Board. Any member of the Board may request at any time an executive session without the presence of management. Executive sessions or meetings with the CEO shall be held from time-to-time for a general discussion of relevant topics.

Paid Consulting Arrangements. The Board believes that the company should not enter into paid consulting arrangements with independent directors.Directors.

Board Compensation. Board compensation should encourage alignment with shareholders’ interests and should be at a level equitable to comparable companies. The Management Development and Compensation Committee is responsible for periodic assessments to assure these standards are being met.

Share Ownership Guidelines for Executive Officers and Directors. The Board has established the stock ownership guidelines described below for executive officers and directors. For purposes of these guidelines, stock ownership includes the fair market value of (1) all shares of common stock owned outright, (2) unvested restricted stock and restricted stock units that are subject only to time-vesting, net of an assumed effective tax rate of 40%, and (3) vested stock options, net of an assumed effective tax rate of 40%. The fair market value of stock options shall mean the then-current market price less the exercise price. Unvested performance shares, whetherDirectors as further described in the formCompensation Discussion and Analysis beginning on page 30 of restricted stock or restricted stock units, will not count toward stock ownership.this Proxy Statement and as summarized below.

| Executive Officer Ownership Guidelines. |

| Board Ownership Guidelines. Within five years of joining the company’s Board of Directors, each |

Prohibition of Hedging or Pledging of Shares. Under our policy with respect to trading in the company’s securities, directors,Directors, officers and other employeesteam members whose duties regularly bring them into contact with confidential or proprietary information (“insiders”) are prohibited from engaging in any form of hedging or monetization transactions involving the company’s securities. In addition, insiders are prohibited from engaging in short sales of the company’s securities and from trading in any form of publicly traded options, puts, calls or other derivatives of the company’s securities. Insiders are also prohibited from engaging in any form of pledging of the company’s securities, including (i) purchasing company securities on margin; (ii) holding company securities in any account which has a margin debt balance; (iii) borrowing against any account in which company securities are held; or (iv) pledging company securities as collateral for a loan.

Conflicts of Interest. Directors are expected to avoid any action, position or interest which conflicts with an interest of the company, or that gives the appearance of a conflict. If any member of the Board becomes aware of any such conflicting or potentially conflicting interest involving any member of the Board, the directorDirector should immediately bring such information to the attention of the Chairman of the Board, the Chief Executive Officer and the General Counsel of the company.